The United Arab Emirates (UAE), particularly Dubai and Abu Dhabi, has emerged as a global financial hub, attracting investors from around the world with its lucrative opportunities and business-friendly environment. However, this rapid growth has also made the region a target for fraudulent investment schemes. Scammers often exploit regulatory gaps, investor greed, and lack of awareness to deceive individuals and businesses. This article provides a comprehensive guide on how to identify and avoid fraudulent investment schemes in the UAE, ensuring your financial security.

Understanding Fraudulent Investment Schemes

Fraudulent investment schemes are deceptive practices designed to lure individuals into investing their money under false pretenses. These scams often promise high returns with minimal risk, preying on the desire for quick wealth. Common types of fraudulent schemes include Ponzi schemes, pyramid schemes, unlicensed investment firms, and fake cryptocurrency platforms.

In the UAE, such schemes have become increasingly sophisticated, using professional marketing materials, fake testimonials, and even counterfeit licenses to appear legitimate. Recognizing the warning signs is the first step toward protecting yourself.

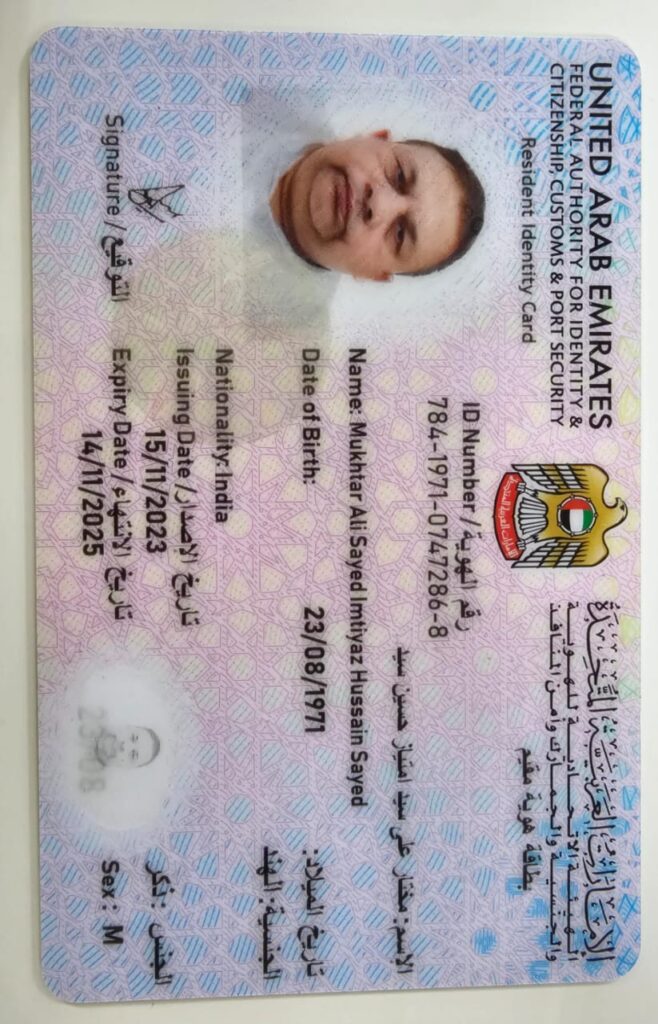

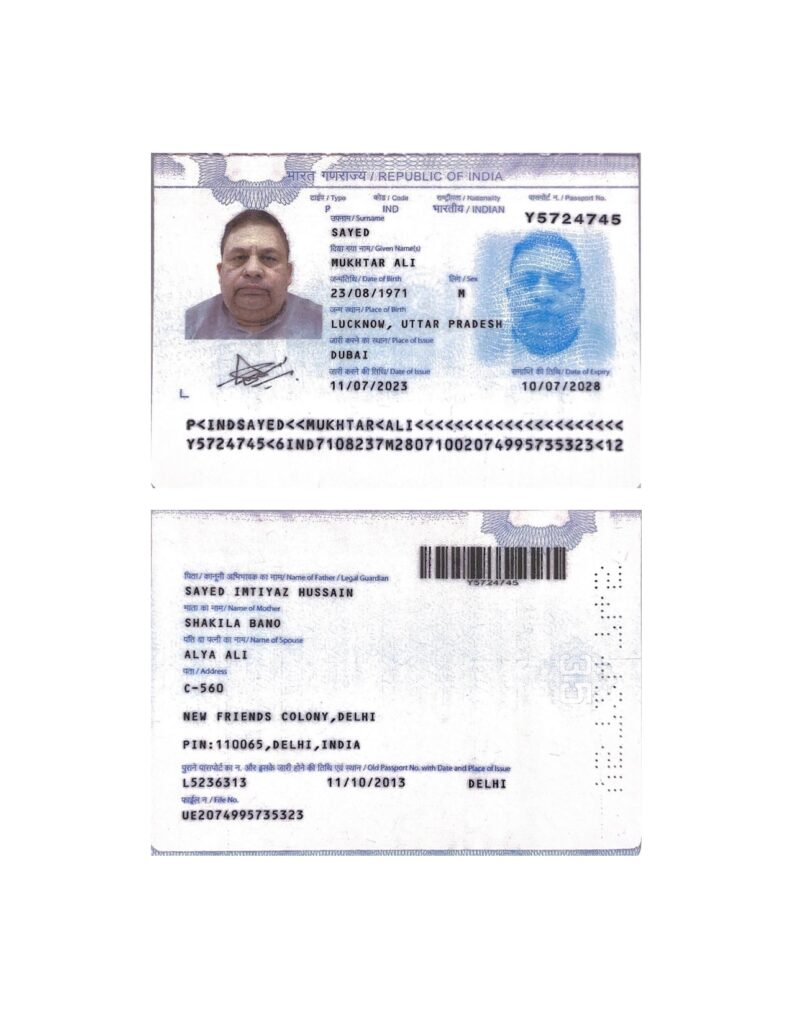

Sayed Mukhtar Ali Passport Copy

Warning Signs of Fraudulent Investment Schemes

- Unrealistic Returns

If an investment promises exceptionally high returns (e.g., 20-30% monthly) with little or no risk, it’s likely a scam. Legitimate investments always carry some level of risk. - Lack of Transparency

Fraudulent firms often provide vague or incomplete information about their business model, operations, or where your money will be invested. They may avoid answering direct questions or providing documentation. - Unlicensed Operations

Many scammers operate without proper licenses from regulatory authorities like the Securities and Commodities Authority (SCA) or the Dubai Financial Services Authority (DFSA) . Always verify the firm’s licensing status before investing. - Pressure Tactics

Scammers use high-pressure sales tactics, urging you to act quickly or miss out on a “once-in-a-lifetime” opportunity. Legitimate firms allow you time to conduct due diligence. - Complex or Unclear Structures

Fraudulent schemes often use complicated structures to confuse investors and hide their true intentions. If you can’t understand how the investment works, it’s a red flag. - Unverifiable Track Record

Scammers may claim a successful track record but fail to provide verifiable evidence. Look for independent reviews, testimonials, and audited financial statements. - Difficulty Withdrawing Funds

A common tactic used by scammers is making it difficult or impossible for investors to withdraw their money once it’s deposited. This is a major warning sign.

Case Study: Ali Cloud Investment LLC

Overview of Ali Cloud Investment LLC

Ali Cloud Investment LLC presented itself as a reputable asset management and investment banking firm based in Dubai. The company claimed to offer innovative solutions for wealth creation, targeting both individual and institutional investors. Below are the details provided by the firm:

- Chairman: Mr. S.M. Ali

- License Number: 1070251

- Address: Office #510, Floor 5th, Al Fattan Plaza, Al Garhoud, PO Box 237270, Dubai-UAE

- Phone Numbers: +971 4880 3272, +971 05 0944 9326

Bank Account Details

The company requested investors to attach copies of their Emirates ID and passport for verification purposes. It also provided the following bank account details for fund transfers:

- Bank Name: Emirates NBD Bank

- Account Name: Mukhtar Ali Sayed

- IBAN: AE230260001015875050001

- Account Number: 1015875050001

- Currency: AED

- Swift Code: EBILAEAD

- Routing Number: 302620122

Red Flags Identified

Despite its polished image, Ali Cloud Investment LLC raised several red flags:

- Unverified License: Investigations revealed that the company was not properly licensed by the DFSA or SCA, despite claiming to hold License Number 1070251.

- Misleading Claims: Investors reported difficulties in withdrawing funds and a lack of clarity regarding where their money was being allocated.

- Ceased Operations: By 2020, the company had ceased operations, leaving many investors financially devastated.

These issues highlight the importance of verifying licenses, conducting due diligence, and remaining vigilant against overly aggressive sales pitches.

Steps to Avoid Fraudulent Investment Schemes

- Verify Licensing and Regulatory Compliance

Before investing, confirm that the firm is licensed by the relevant UAE regulatory authorities:- Dubai Financial Services Authority (DFSA) for firms operating in the DIFC.

- Securities and Commodities Authority (SCA) for firms outside the DIFC.

- Central Bank of the UAE for banking and financial services.

You can check the licensing status on the official websites of these authorities.

- Conduct Thorough Due Diligence

Research the company’s background, including its history, leadership team, and past performance. Look for independent reviews, complaints, and litigation history. Use resources like the DFSA’s Investor Alert List to identify unlicensed or fraudulent firms. - Be Skeptical of High Returns

If an investment opportunity seems too good to be true, it probably is. Always compare the promised returns with industry standards and assess the associated risks. - Seek Professional Advice

Consult a financial advisor, lawyer, or accountant before making significant investment decisions. Professionals can help you evaluate the legitimacy of the opportunity and identify potential red flags. - Avoid Pressure Sales Tactics

Legitimate firms do not pressure investors into making quick decisions. Take your time to research and evaluate the proposal thoroughly. - Check for Transparency

Ensure the firm provides clear and detailed information about its operations, financials, and investment strategy. Avoid companies that are evasive or refuse to answer your questions. - Monitor Your Investments

Regularly review your investments and stay informed about the firm’s activities. If you notice irregularities, such as delayed payments or lack of communication, take immediate action. - Report Suspicious Activity

If you suspect fraudulent activity, report it to the relevant authorities, such as the DFSA or SCA. Your actions could help prevent others from falling victim to the same scam.

Regulatory Bodies in the UAE

The UAE has established robust regulatory frameworks to protect investors and maintain the integrity of its financial markets. Key regulatory bodies include:

- Dubai Financial Services Authority (DFSA)

Regulates firms operating within the Dubai International Financial Centre (DIFC). - Securities and Commodities Authority (SCA)

Oversees financial markets and investment firms outside the DIFC. - Central Bank of the UAE

Regulates banking and financial services across the country.

These authorities play a critical role in combating fraud and ensuring compliance with legal and ethical standards.

Conclusion

While the UAE offers numerous legitimate investment opportunities, it also attracts fraudulent schemes that prey on unsuspecting investors. By staying informed, verifying licenses, and exercising caution, you can protect yourself from falling victim to scams. Remember, if something feels off or too good to be true, trust your instincts and investigate further. Your financial security depends on making informed decisions and avoiding shortcuts.

Investing in the UAE’s dynamic market can be highly rewarding, but it also requires vigilance and due diligence. Stay informed, stay vigilant, and invest wisely.

FAQs

- What are the most common types of investment scams in the UAE?

Ponzi schemes, pyramid schemes, unlicensed investment firms, and fake cryptocurrency platforms are among the most common types of scams. - How can I verify if an investment firm is licensed in the UAE?

Check the official websites of the DFSA, SCA, or Central Bank of the UAE for licensing information. - What should I do if I suspect an investment scam?

Report it to the relevant authorities, such as the DFSA or SCA, and consult a legal advisor for guidance. - Are all high-return investments scams?

Not necessarily, but investments promising unusually high returns with no risk are often red flags. - Why is regulatory oversight important in investments?

Regulatory oversight ensures that investment firms operate legally, transparently, and ethically, protecting investors from fraud. - What happened to Ali Cloud Investment LLC?

The company ceased operations amid allegations of misleading claims, lack of transparency, and difficulties in fund withdrawals. - What were the issues with AXX Investment LLC?

AXX Investment LLC faced scrutiny for questionable practices, unfulfilled promises, and a lack of proper licensing. - How can I protect myself from investment scams?

Verify licenses, conduct due diligence, avoid high-pressure sales tactics, and seek professional advice. - What role does due diligence play in avoiding scams?

Due diligence helps you assess a firm’s credibility, financial health, and reputation, reducing the risk of fraud. - Where can I find more information about investment scams in the UAE?

Visit the DFSA’s Investor Alert List or the SCA’s website for updates on fraudulent firms and scams.