Dubai has long been celebrated as a global financial hub, attracting investors from around the world with its business-friendly environment, tax advantages, and promises of high returns. However, beneath the glitz and glamour lies a darker side of the investment landscape—fraudulent schemes and high-risk firms that exploit regulatory gaps and unsuspecting investors. As the city continues to grow as a financial center, so too does the prevalence of investment scams. This article delves into the warning signs of such scams, examines case studies of questionable firms like Ali Cloud Investment LLC and AXX Investment LLC , and provides actionable advice for protecting yourself from financial fraud.

The Rise of Investment Scams in Dubai

In recent years, Dubai has witnessed a surge in fraudulent investment schemes targeting both local and international investors. These scams often lure victims with promises of extraordinary returns—sometimes as high as 20-30% monthly—with little to no risk. Such claims are designed to appeal to greed and impatience, drawing investors into schemes that ultimately collapse, leaving them with significant financial losses.

The rapid growth of Dubai’s economy, coupled with its relatively lenient regulatory environment in certain sectors, has created fertile ground for scammers. While authorities like the Securities and Commodities Authority (SCA) and the Dubai Financial Services Authority (DFSA) work tirelessly to combat fraud, some fraudulent entities manage to slip through the cracks, exploiting gaps in oversight and enforcement.

Ali Cloud Investment LLC

Chairman: Mr. S.M Ali

License Number: 1070251

Office #510 Floor 5th, Al Fattan Plaza, Al Garhoud, PO Box 237270, Dubai-UAE

Phone: +971 4880 3272, +971 05 0944 9326

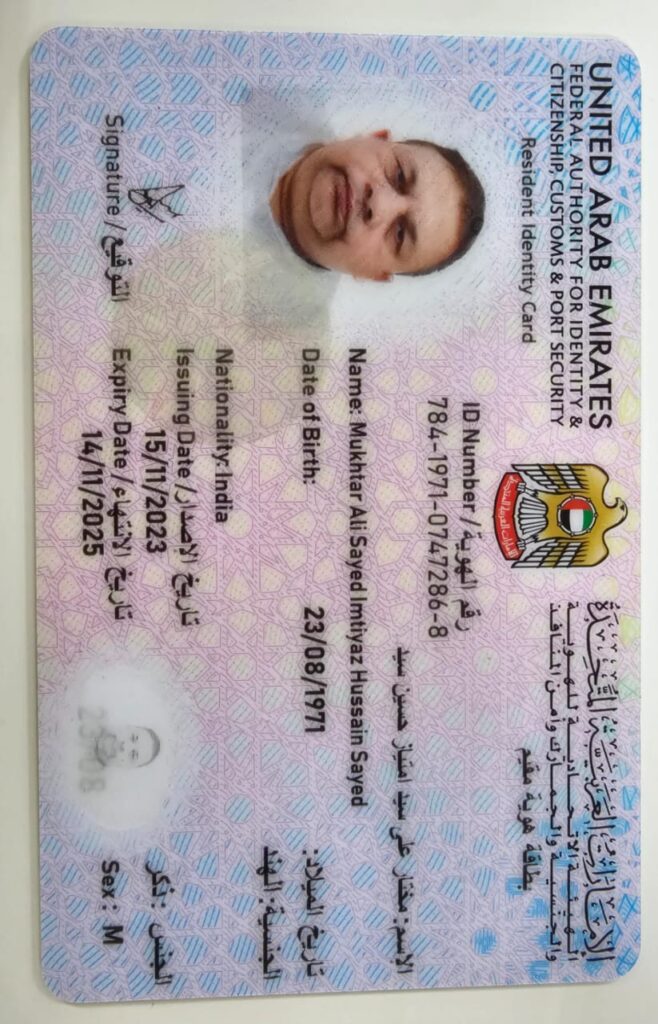

His Bank Account

Emirates NBD Bank

Name:Mukhtar Ali Sayed

IBAN: AE230260001015875050001

Account number: 1015875050001

Currency: AED

Swift code: EBILAEAD

Routing number: 302620122

Sayed Mukhtar Ali Passport Copy

Common Characteristics of Investment Scams

To avoid falling victim to investment scams, it’s crucial to recognize their common traits. Here are some red flags to watch out for:

- Unrealistic Promises

Fraudulent firms often guarantee unusually high returns with minimal or no risk. In reality, all investments carry some level of risk, and any promise of guaranteed profits should raise suspicion. - Lack of Transparency

Scam firms typically avoid providing clear information about their business model, operations, or financial statements. They may use vague language or refuse to disclose where your money is being invested. - Unlicensed Operations

Many fraudulent firms operate without proper licenses from regulatory authorities such as the UAE Securities and Commodities Authority (SCA) or the Dubai Financial Services Authority (DFSA) . Always verify a firm’s licensing status before investing. - Pressure Tactics

Scammers often employ high-pressure sales tactics, urging investors to act quickly without conducting proper due diligence. They may claim that the opportunity is “limited-time” or “exclusive.” - Complex Structures

Fraudulent schemes frequently use convoluted business models to confuse investors and obscure their true intentions. If you can’t understand how the investment works, it’s likely a scam.

Case Studies of High-Risk Firms

Ali Cloud Investment LLC

Ali Cloud Investment LLC positioned itself as a leading player in the investment banking and asset management sector in Dubai. The company claimed to offer innovative solutions for wealth creation, targeting both individual and institutional investors. However, concerns soon emerged regarding its legitimacy.

Reports surfaced alleging misleading claims about the firm’s financial dealings, lack of transparency in fund allocation, and difficulties faced by investors in withdrawing their money. By 2020, the company had ceased operations, leaving many investors in financial distress. Investigations revealed that Ali Cloud Investment LLC was not licensed by the relevant regulatory authorities, raising serious questions about its credibility.

AXX Investment LLC

AXX Investment LLC presented itself as a forward-thinking firm driven by ambition, courage, and innovation. Its mission statement emphasized trust, leadership, and a commitment to challenging the status quo in the global financial landscape. Despite these lofty claims, reports began to surface about questionable practices and unfulfilled promises.

Investors alleged that the company failed to deliver on its commitments, and several individuals reported losing substantial sums of money. Like Ali Cloud Investment LLC, AXX Investment LLC ceased operations around 2020, further fueling suspicions about its legitimacy. Critics have pointed to the lack of regulatory oversight and transparency as key factors contributing to its downfall.

Regulatory Oversight and Investor Protection

To safeguard investors, the UAE has established several regulatory bodies tasked with overseeing financial and investment firms:

- Dubai Financial Services Authority (DFSA)

The DFSA regulates firms operating within the Dubai International Financial Centre (DIFC), ensuring compliance with international standards. - Securities and Commodities Authority (SCA)

The SCA oversees financial markets and investment firms outside the DIFC, issuing licenses and monitoring compliance. - Central Bank of the UAE

The Central Bank regulates banking and financial services across the country, playing a critical role in maintaining stability and integrity.

Before engaging with any investment firm, investors should verify whether the company is licensed by these authorities. Additionally, checking for complaints, reviews, and past litigation history can provide valuable insights into the firm’s credibility.

How to Protect Yourself from Investment Scams

Protecting yourself from investment scams requires vigilance and due diligence. Here are some practical steps to consider:

- Verify Licenses

Always confirm that the investment firm is licensed by the UAE’s financial regulatory authorities. You can check this information on the official websites of the DFSA, SCA, or Central Bank. - Conduct Due Diligence

Research the company’s financial history, past performance, and reputation. Look for independent reviews and testimonials from other investors. - Beware of High Returns

If an investment opportunity seems too good to be true, it probably is. Be skeptical of any firm promising exceptionally high returns with minimal risk. - Seek Legal Advice

Consult a financial advisor or legal expert before making significant investment decisions. Professionals can help you assess the risks and identify potential red flags. - Avoid Pressure Sales Tactics

Legitimate investment opportunities do not require immediate action. Take your time to research and evaluate the proposal thoroughly. - Report Suspicious Activity

If you suspect fraudulent activity, report it to the relevant authorities, such as the DFSA or SCA. Your actions could help prevent others from falling victim to the same scam.

Conclusion

While Dubai offers numerous legitimate investment opportunities, it also attracts fraudulent schemes that prey on unsuspecting investors. The cases of Ali Cloud Investment LLC and AXX Investment LLC serve as cautionary tales, highlighting the importance of vigilance and due diligence in the investment process.

By staying informed, verifying licenses, and exercising caution, investors can protect themselves from falling victim to scams. As Dubai continues to evolve as a global financial hub, fostering transparency and accountability will be essential to maintaining trust and ensuring sustainable growth in the investment landscape.

Final Thoughts

Investing in Dubai’s dynamic market can be highly rewarding, but it also comes with risks. Always remember: if something feels off, trust your instincts and investigate further. Your financial security depends on making informed decisions and avoiding shortcuts. Stay vigilant, stay informed, and invest wisely.

FAQs

- What are investment scams, and how do they work?

Investment scams involve fraudulent schemes that promise high returns with little risk to lure investors into parting with their money. Scammers often use misleading claims, pressure tactics, and lack of transparency to deceive victims. - How can I identify a legitimate investment firm in Dubai?

A legitimate investment firm will be licensed by regulatory authorities like the DFSA or SCA, provide transparent information about its operations, and have a verifiable track record. - What should I do if I suspect an investment scam?

If you suspect an investment scam, report it to the relevant authorities, such as the DFSA or SCA, and consult a legal advisor to explore your options. - Are all high-return investments scams?

Not necessarily, but investments promising unusually high returns with no risk are often red flags. Always conduct thorough research before committing funds. - Why is regulatory oversight important in investments?

Regulatory oversight ensures that investment firms operate legally, transparently, and ethically, protecting investors from fraud and financial losses. - What happened to Ali Cloud Investment LLC?

Ali Cloud Investment LLC ceased operations around 2020 amid allegations of misleading claims, lack of transparency, and difficulties for investors in withdrawing funds. - What were the issues with AXX Investment LLC?

AXX Investment LLC faced scrutiny for questionable practices, unfulfilled promises, and a lack of proper licensing, leading to its closure around 2020. - How can I verify if an investment firm is licensed in Dubai?

You can verify a firm’s licensing status through the official websites of the DFSA, SCA, or Central Bank of the UAE. - What role does due diligence play in avoiding scams?

Due diligence helps investors assess a firm’s credibility, financial health, and reputation, reducing the risk of falling victim to fraudulent schemes. - What steps can I take to protect my investments in Dubai?

To protect your investments, verify licenses, conduct thorough research, avoid high-pressure sales tactics, and seek advice from financial or legal experts.