Stratview Research has recently published a report on Small Satellites Market segmented by Size, Share, Trend, Forecast, Competitive Analysis, and Growth Opportunity: 2022-2026. The objective of the market experts at Stratview Research is to conduct a thorough analysis of ‘Small Satellites’ and put a detailed knowledge about the industry and business attractiveness, revenue, market size, segmentation, growth, and restraining factors so that the user gets in-depth information about the industry and the business from a past, current and a future perspective and can potentially invest capital for further growth.

Market Insights

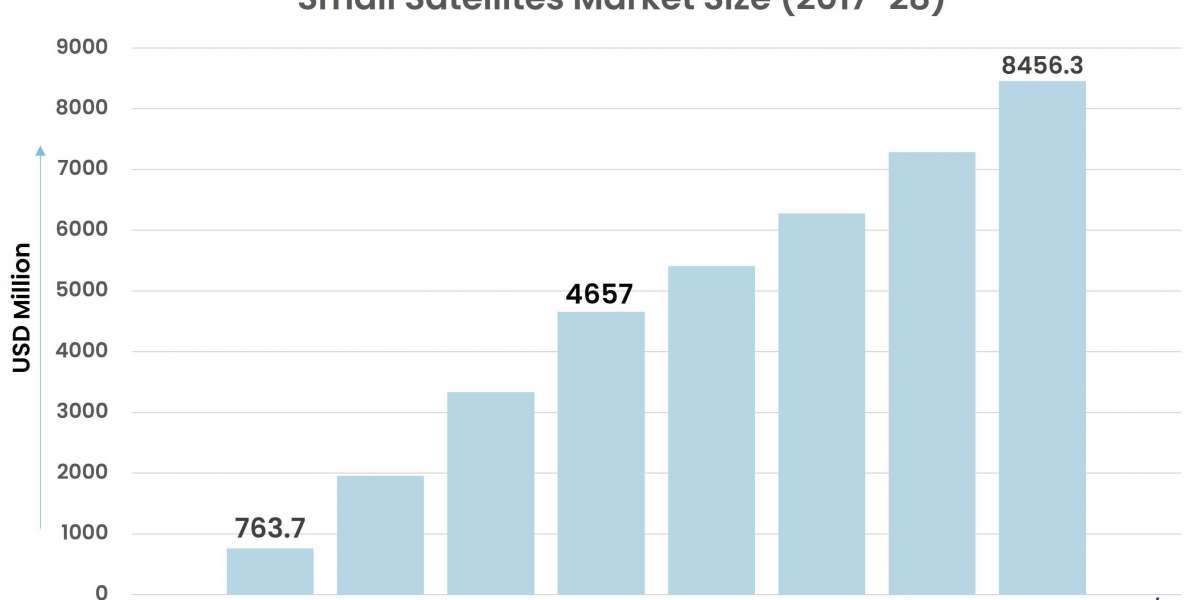

The small satellites market grew from USD 763.7 million in 2017 to USD 4657.0 million in 2022, exhibiting a growth of 500%. Also, it estimates that in the coming 5 years, the market will reach USD 8,456.3 million, almost double what it is in the year 2022.

Additionally, the report covers a variety of established and emerging start-ups and organisations operating in the industry. As organization’s report provides a comparative analysis by presenting the user with various aspects of the markets discussed in the report.

Market Highlights

Miniaturized satellites having a wet mass of under 500 KG are considered under the small satellites category. The weight of the small satellites varies as per the components and sensors installed in them. These satellites have a shorter development team and cycles; thus, can be developed and launched at a lower cost in comparison to traditional large satellites.

The number of small satellites launched in the past few years has surged substantially owing to its low cost, easier launch vehicle integration, and technological developments. SpaceX’s robust plan of launching about 12,000 satellites in the Starlink constellation, of which half of them are targeted to be launched by end of 2024, is signalling a highly optimistic near-term outlook of the industry, especially of small satellite ones.

The small satellites market plunged in 2016 mainly due to launch failures. It further dropped slightly in 2018 when compared to 2017, owing to the decline in the number of small satellite launches. However, the market witnessed a robust pace in 2020 especially due to the launch of the Starlink internet satellite by SpaceX.

COVID-19 IMPACT

The COVID-19 outbreak had a negligible impact on the small satellites market due to the longer project timelines for launching and establishing services. However, the temporary halt of satellite production lines, postponement of launches, and limited availability of funding led to some turbulence amid the pandemic.

Segment-wise analysis

The report encompasses in-depth segmentations like regional segmentation, segmentation by product types, application-wise segmentation, geographical segmentation and thereby gives the user an overview of the effectiveness of the segmentation by various classes.

Based on the type, the market is segmented as minisatellite, microsatellite, nanosatellite, and picosatellite. The minisatellite is expected to remain the largest and fastest-growing segment of the market during the forecast period. Minisatellites are satellites weighing between 201-500 kg. These satellites are simpler and use similar technologies as larger satellites. SpaceX is the leading player in the minisatellite sector and is primarily employing these satellites for communication and broadband internet services.

Based on the application type, the market is segmented as earth observation, technology development, communications, and scientific. Communications are expected to remain the largest segment of the market during the forecast period. Rising demand for high-speed internet services coupled with growing digitalization across various verticals is augmenting the demand for smallsats, especially for communication purposes.

In terms of regions, North America is projected to remain the largest market for small satellites in the foreseeable future. The USA is the pioneer in the smallsats market. In the year 2020, new small satellite launches in the USA grew six-fold from that of the 2019 level, mainly driven by SpaceX’s Starlink constellation. Leading players, such as Planet Labs and SpaceX, are vertically integrated, having a stronghold from raw material procurement to the provision of internet services.

Asia-Pacific is likely to recoup at an impressive rate during the forecast period. The strong growth of the region is mainly attributable to the growing emphasis on the production and launch of smallsats to cater to the need for broadband connectivity solutions, military support, and weather forecasting. China is the leading contributor in the region in the wake of strong expenditure in space exploration and defense activities.

What we do-

Stratview Research is a global market research and consulting company. We provide unmatched quality of offerings to our clients existing globally. We at Stratview Research are obliged to serve our diverse customer base present across the industries of Aerospace, Oil and Gas, Automotive, and Chemicals, etc. among various other industries present around the world. We strive to provide our customers with updated information on ground-breaking technologies, high growing markets, emerging business environments and latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities.