Fintech apps are shaking up how everyday people manage their financial lives. By combining powerful technology with elegant interfaces, these apps deliver sophisticated capabilities directly to consumers to enhance their personal finances.The advent of fintech apps has transformed the way we manage our personal finances. These innovative applications leverage technology to provide convenient, secure, and user-friendly solutions for various financial needs. In this blog post, we will explore seven ways in which fintech apps are revolutionizing personal finance, empowering individuals to take control of their money and make informed financial decisions.

1. Streamlined Budgeting and Expense Tracking

Fintech apps offer robust budgeting and expense tracking features that enable users to gain a comprehensive understanding of their spending habits. These apps automatically categorize expenses, provide visual representations of spending patterns, and send real-time notifications to help users stay within their budget. By offering this level of transparency, fintech apps empower individuals to make more informed financial decisions and achieve their savings goals.

2. Seamless Mobile Banking

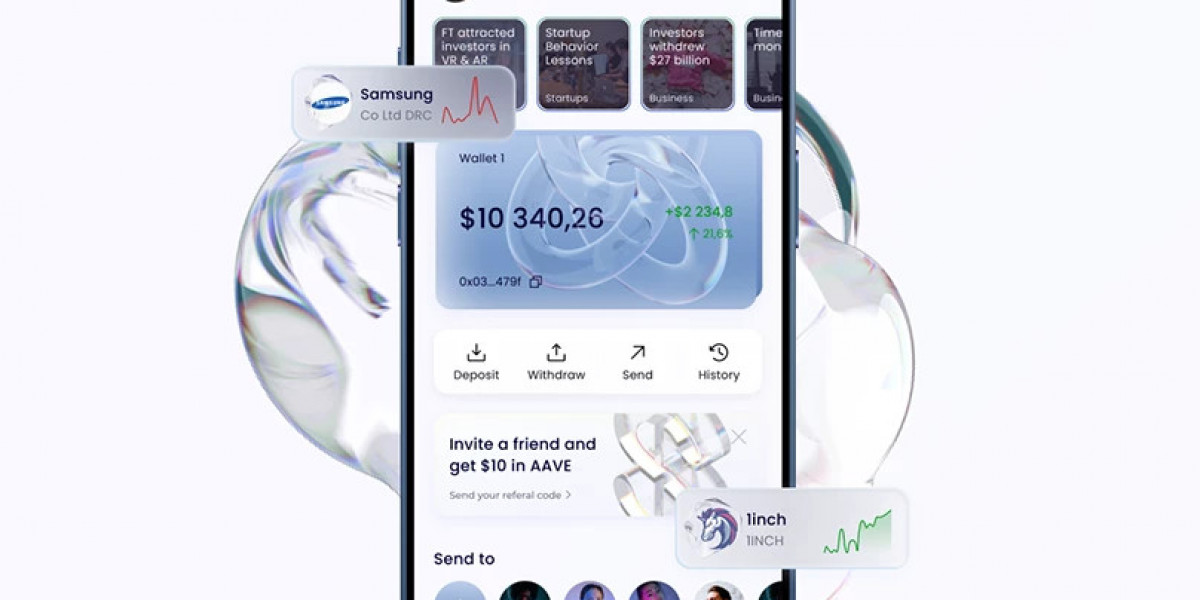

Gone are the days of visiting physical bank branches or waiting in long queues. Fintech apps have revolutionized mobile banking, providing users with convenient access to their accounts anytime, anywhere. These apps allow individuals to perform a wide range of banking operations, including balance inquiries, fund transfers, bill payments, and even applying for loans or credit cards. With enhanced security measures such as biometric authentication and encryption, fintech apps ensure the safety of users' financial information.

- Also read: Money Transfer App development Guide

3. Automated Savings and Investment

Fintech apps have made saving and investing more accessible and effortless. Through features like round-up savings and automatic transfers, these apps help users save small amounts consistently, which can accumulate over time. Additionally, many fintech apps offer investment options tailored to individual goals and risk preferences. Users can easily set up automated investments, diversify their portfolios, and track the performance of their investments in real-time, all within a single app.

4. Personalized Financial Recommendations

Fintech apps leverage artificial intelligence and machine learning algorithms to analyze users' financial data and provide personalized recommendations. These recommendations can range from optimizing credit card usage to suggesting suitable investment opportunities. By understanding users' financial habits and goals, fintech apps offer tailored advice that can help individuals make better financial decisions and maximize their financial well-being. You can also hire app developers in India for creating fintech mobile apps.

5. Peer-to-Peer Payments

Fintech apps have simplified the process of transferring money between individuals through peer-to-peer payment features. Whether it's splitting bills with friends, paying rent, or reimbursing someone, fintech apps facilitate quick and hassle-free transactions. With features like QR code scanning and instant notifications, users can send and receive money securely, eliminating the need for cash or traditional payment methods.

6. Access to Alternative Financial Services

Fintech apps have opened doors to alternative financial services for individuals who may have limited access to traditional banking. These apps provide services such as microloans, micro-investing, and micro-insurance, catering to the needs of underserved populations. By leveraging technology and alternative data sources, fintech apps enable financial inclusion and empower individuals to improve their financial well-being.

- Also check: Top Fintech App Development Companies

7. Enhanced Security and Fraud Protection

Fintech apps prioritize the security of users' financial information. They employ advanced encryption techniques, multi-factor authentication, and real-time fraud detection to safeguard transactions and protect against unauthorized access. With features like instant transaction alerts and the ability to temporarily freeze or block cards, users have greater control over their financial security.

Conclusion

Fintech apps have transformed personal finance by offering streamlined budgeting, convenient mobile banking, automated savings and investment options, personalized recommendations, peer-to-peer payments, access to alternative financial services, and enhanced security measures. These apps empower individuals to take control of their finances, make informed decisions, and achieve their financial goals. As fintech continues to evolve, we can expect even more innovative solutions that revolutionize personal finance in the years to come. Discuss this with a fintech app development services provider to get the more detailed understanding of it.