The Generative AI in Life Insurance Market is poised for substantial growth, with a projected value of USD 1,739.9 Million by 2033, driven by advancements in artificial intelligence (AI) technology. Generative AI, which leverages machine learning algorithms to create synthetic data, enables life insurance companies to extract insights from vast datasets for improved risk assessment, underwriting, and customer profiling.

The market is expected to witness a remarkable surge, with a projected Compound Annual Growth Rate (CAGR) of 28.77% during the forecast period from 2024 to 2033. Cloud-based solutions dominate the market, capturing over 70% share in 2023, offering scalability, flexibility, and cost-effectiveness to insurers.

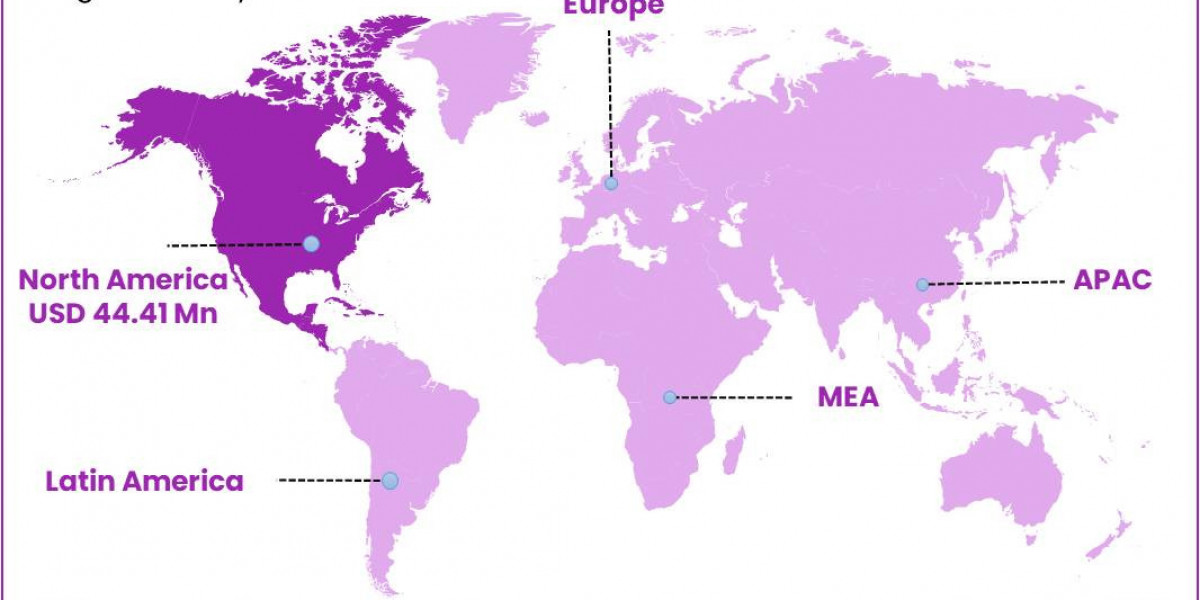

Natural Language Processing (NLP) emerges as a key technology segment, holding a dominant market position in 2023, facilitating customer interactions and streamlining claims processing. The Personalized Policy Recommendations segment leads the market, driven by the growing demand for customized insurance products. North America leads the market with a dominant share of over 32% in 2023, attributed to its mature life insurance industry and robust digital infrastructure.

Key influencers in market growth include the increasing volume and variety of data, regulatory environment, enhanced underwriting, and risk assessment processes. Collaboration between life insurance companies and technology providers also plays a pivotal role in market expansion. Report segmentation highlights the dominance of cloud-based deployment, NLP technology, personalized policy recommendations, and the involvement of life insurance companies as end-users.

The market is further segmented by geography, with North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa being key regions driving market growth. Overall, the Generative AI in Life Insurance Market presents significant opportunities for insurers to enhance operational processes, improve customer experience, and gain a competitive edge in the evolving insurance landscape.