Introduction

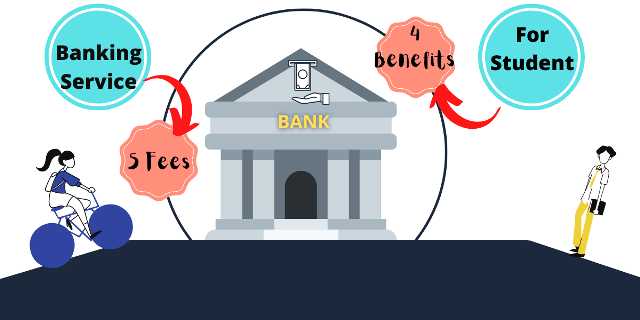

This lesson of Banking Services I am going to introduce you with: Why you’d want a checking, savings, or other bank accounts 5 fees you need to know by name, 4 benefits to banking Welcome to Banking Basics. In this first part of the Banking Basics set, we’ll discuss the bank accounts most likely used by college students, we’ll name 5 fees that you need to know and avoid, and we’ll give you 4 benefits of banking. Let’s get started with the money that’s in your wallet. This is likely where your banking relationship begins. Because the cash in this account doesn’t usually stay within the bank very long, these accounts generally gain little or no interest.

Savings accounts

Savings accounts, on the other hand, typically earn you a higher interest rate because there are fewer transactions and the money generally stays in the account longer. It’s a good rule of thumb to transfer a little money from your checking into your savings every month if you can afford it. A CD’s interest rate is usually higher than a normal savings account interest rate. In exchange, you agree to not take away the cash for a set number of months.

5 fees

The money still belongs to you and you'll take it out sooner if needed, but there’s generally a fee involved. Speaking of fees, here are 5 fees that you need to be aware of when considering your banking relationship. It happens when you withdraw more money from your account than you have in there.

- NSF Fee – Also known as non-sufficient funds fees or overdraft fees.

- ATM Fee – This fee is for the convenience of using an ATM to induce cash.

- Check to Order Fee – The cost to order paper checks

- Monthly Account Fees – Some banks charge a fee if you not put a minimum balance or meet other requirements.

- Online Bill Pay Fee – A fee for the convenience of paying bills online. Ignore these fees and your banking relationship can bear interest and be fruitful.

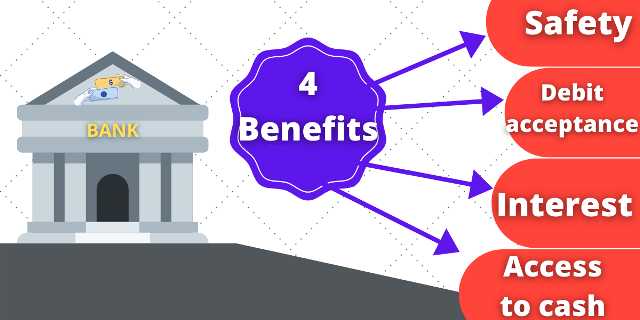

4 Benefits

Here are 4 benefits of banking.-

- Safety – The biggest advantage of keeping your money in the bank is that its FDIC insured – which means your money, is safe up to the FDIC limit.

- Debit acceptance – Your debit card is likely accepted at most of the places you shop. That buying power is a great convenience.

- Interest – With interest, the bank pays you money as an incentive to keep your money in the bank.

- Access to cash – With ATMs it’s easy to get cash quickly. With so many benefits, properly handling your accounts becomes your next responsibility