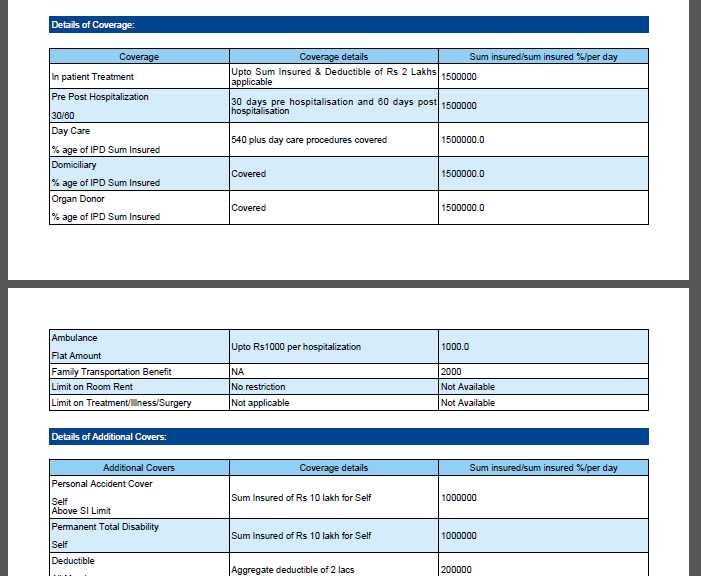

| Coverage (Basic Cover) | Sum Insured (INR) |

|---|---|

| Inpatient Treatment | Up to Sum Insured limit |

| Pre/Post Hospitalization (30/60 Days) | Up to Sum Insured limit |

| 140 Daycare procedures | Up to Sum Insured limit |

| Domiciliary Treatment | Up to Sum Insured limit |

| Emergency Ambulance | Maximum INR 2000 per Hospitalisation |

| Organ Donor | Up to Sum Insured limit |

| Nursing Allowance | Covered, INR 100 per day up to a maximum of 15 days with a deductible of 2 days |

| Family Transportation | Up to Rs.5000 |

Policy Coverage:

Group MediPrime policy coverage includes 140 listed day-care procedures, Accidental Dental, Family Transportation among many others. Along with the benefit of cashless hospitalization, you can also enjoy the tax benefit associated with the policy under section 80D. To know in detail, we request you to go through the below policy coverage for group MediPrime.

- Entry age (18 to 55 years) - Age of the primary insured and spouse should be between 18-55 years, age of dependent children (up to 2 covered) should be between 91 days and 25 years

- No pre-policy medicals - No pre-policy medical check-up required

- Inpatient Hospitalisation and Pre-Post Hospitalisation - Hospitalisation Expenses as an in-patient due to an illness or accident and pre and post-hospitalization related to the hospitalization for 30 and 60 days respectively are covered

- 140 listed daycare procedures covered

- Reimbursement of Medical Treatment at Home - Medical expenses incurred by an insured person for availing medical treatment at his home which would otherwise have required hospitalization*

- Domiciliary Expenses

- Family Transportation - Reimbursement of actual expenses incurred in transporting immediate Family Member from the Insured Person’s residence to the hospital

- Organ donor - In-patient medical expenses incurred on the insured and the organ donor for harvesting for organ transplantation is covered

- Accidental Dental covered - Avail benefit on dental treatment, in case of an accident and requiring hospitalization

- Family Floater - Benefit of insuring up to 4 family members in a plan

- No sub-limits - No disease-wise sub-limits or capping is applicable

- No co-pay is applicable

- Cashless hospitalization - Cashless service provided by the insurance partner at the network hospital

- **Tax Benefit: Enjoy Tax Benefits under section 80D

Policy Exclusions:

There are certain policy exclusions applicable here. Few cases such as Maternity and related conditions, cosmetic or preventive treatment, etc. are not covered in this policy. Before availing the policy, we ask you to go through the Group MediPime policy exclusions listed below in detail.

- Any treatment within the first 30 days of cover except any accidental injury

- 1 year waiting period for specified illnesses/treatments/surgeries

- Any Pre-existing diseases/conditions

- Maternity and related conditions

- The abuse of intoxicants or hallucinogenic substances including but not limited to smoking cessation programs and the treatment of nicotine addiction or any other substance abuse treatment

- Psychiatric or mental disorders (including mental health treatments), congenital internal or external diseases (known / unknown), defects or anomalies, genetic disorders; stem cell implantation/ therapy or surgery, or growth hormone therapy

- Any cosmetic treatment, preventive treatment

- War or any act of war, invasion, the act of a foreign enemy, warlike operations (whether war be declared or not or caused during service in the armed forces of any country), civil war, public defense, rebellion, revolution, insurrection, military or usurped acts, nuclear weapons/materials, chemical and biological weapons, radiation of any kind

- Treatment of obesity or any weight control program, sexually transmitted disease, “AIDS” (Acquired Immune Deficiency Syndrome) and/or infection with HIV (Human immunodeficiency virus), sterility/infertility treatment of any type, laser treatment for correction of the eye due to refractive error, aesthetic or change-of-life treatments, experimental, investigational or unproven treatment

Insurance Copy