Global Artificial Intelligence (AI) in BFSI Industry: Key Statistics and Insights in 2024-2032

Summary:

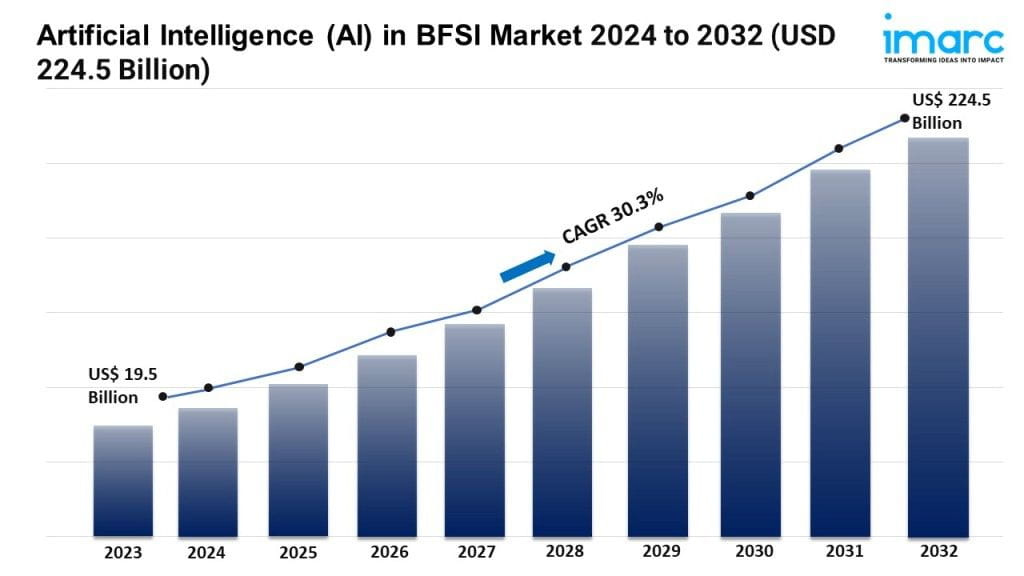

- The global artificial intelligence (AI) in bfsi market size reached USD 19.5 Billion in 2023.

- The market is expected to reach USD 224.5 Billion by 2032, exhibiting a growth rate (CAGR) of 30.3% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest artificial intelligence (AI) in bfsi market share.

- BFSI (Banking, Financial Services, and Insurance) firms are using AI models more. They analyze market trends, find new opportunities, and improve investment strategies. This approach enables them to remain competitive and increase returns.

- Organizations are also focusing on compliance. They are using AI to automate checks. It lets them monitor transactions for suspicious activities in real time and follow strict regulations.

- AI is crucial for reducing the risks of not following regulations. BFSI institutions use AI for predicting issues and monitoring compliance. This makes them work better and manage risks effectively.

Grab a sample PDF of this report: https://www.imarcgroup.com/artificial-intelligence-in-bfsi-market/requestsample

Industry Trends and Drivers:

- Fraud Detection and Prevention:

AI systems are now monitoring transactions and consumer activities in real-time. This allows for quick detection of fraud patterns or anomalies. Such a proactive approach reduces fraud impact and financial losses for BFSI institutions. AI algorithms analyze large data sets to detect fraud. They identify patterns and behaviors that differ from the norm, improving detection efforts.

- Risk Management:

AI algorithms analyze both structured and unstructured data to assess risks. These include credit, market, operational, and compliance risks. By merging data from various sources, AI risk systems offer more accurate assessments. It helps BFSI institutions make better decisions. AI models analyze past data and market conditions to forecast trends and risks. This helps institutions anticipate and reduce risks. It improves their strategies and protects their assets.

- Data Analytics:

Data analytics processes large amounts of data from BFSI institutions. AI algorithms analyze this data to uncover insights about consumers, markets, and risks. This helps organizations make better decisions. AI models assess and predict risks, such as credit, market, and operational risks. They use historical data and current market conditions. This helps BFSI firms spot and reduce risks. It protects assets and ensures stability.

We explore the factors propelling the artificial intelligence (AI) in bfsi market growth, including technological advancements, consumer behaviors, and regulatory changes.

Artificial Intelligence (AI) in BFSI Market Report Segmentation:

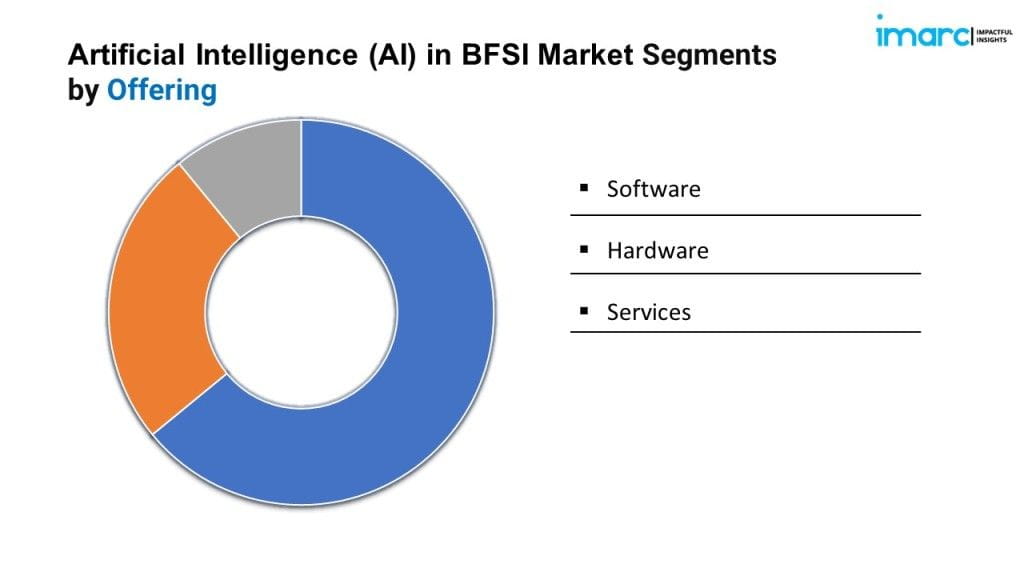

By Offering:

- Software

- Hardware

- Services

Software represents the largest segment due to its versatility, scalability, and ability to integrate seamlessly with existing banking systems.

By Solution:

- Chatbots

- Fraud Detection and Prevention

- Anti-Money Laundering

- Customer Relationship Management

- Data Analytics and Prediction

- Others

Chatbots account for the majority of the market share on account of their ability to provide personalized consumer service, streamline interactions, and enhance user experience.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the artificial intelligence (AI) in BFSI market driven by technological advancements, robust regulatory frameworks, and the presence of leading BFSI institutions.

Top Artificial Intelligence (AI) in BFSI Market Leaders:

The artificial intelligence (AI) in bfsi market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Amelia

- Atos SE

- Avaamo Inc.

- CognitiveScale Inc.

- Inbenta Holdings Inc.

- Interactions LLC

- International Business Machines Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Palantir Technologies Inc.

- SAP SE

- SAS Institute Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145