Global Data Center Liquid Cooling Industry: Key Statistics and Insights in 2025-2033

Summary:

- The global data center liquid cooling market size reached USD 3.5 Billion in 2024.

- The market is expected to reach USD 16.5 Billion by 2033, exhibiting a growth rate (CAGR) of 18.56% during 2025-2033.

- North America leads the market, accounting for the largest data center liquid cooling market share.

- Solution accounts for the majority of the market share in the component segment, as data center operators are seeking to streamline operations and reduce energy consumption.

- Large data centers hold the largest share in the data center liquid cooling industry.

- Enterprises remain a dominant segment in the market, as these organizations require efficient cooling solutions to manage the high heat output of their expanding server networks.

- IT and telecom represent the leading application segment.

- The rising data center power density is a primary driver of the data center liquid cooling market.

- The increasing demand for energy efficiency is reshaping the data center liquid cooling market.

Industry Trends and Drivers:

- Increasing data center power density:

Data centers are using more powerful servers and advanced technologies like AI, ML, and HPC. This shift is increasing the power density in racks, measured in kilowatts (kW). Traditional air-cooling systems can’t keep up with the heat from these high-density racks. As a result, they are becoming inefficient and inadequate. Liquid cooling systems, however, are much more effective. They use fluids to directly cool the equipment, managing the heat from dense servers better. This efficiency is driving the demand for liquid cooling solutions. Meanwhile, air-based cooling methods are struggling. They need more energy and are becoming less effective. Air cooling requires increased airflow and lower temperatures, which raises energy use and costs.

- Rising demand for energy efficiency:

Traditional air-cooling systems use a lot of energy in data centers. They rely on powerful fans and air conditioners. These systems become less efficient with heavier workloads. In contrast, liquid cooling systems are much more energy-efficient. Liquids can conduct and hold heat better than air. This means they cool more effectively, reducing the need for heavy air conditioning. Power usage effectiveness (PUE) measures a data center's energy efficiency. A lower PUE means better efficiency. Liquid cooling lowers PUE by cutting the energy needed for server cooling. This leads to savings and lower costs, which is vital as energy prices rise.

- Technological advancements:

Recent advances in liquid cooling, like immersion, direct-to-chip, and cold plate systems, boost heat removal efficiency. Immersion cooling, for instance, submerges servers in a non-conductive liquid that absorbs heat directly. This method offers better thermal management. These techniques let data centers run at higher power levels without overheating. Moreover, combining liquid cooling with technologies like the Internet of Things (IoT) and artificial intelligence (AI) enhances monitoring and management. Smart systems can adjust flow, temperature, and pressure in real-time based on server workload and heat. This optimizes cooling and energy use.

Request for a sample copy of this report: https://www.imarcgroup.com/data-center-liquid-cooling-market/requestsample

Data Center Liquid Cooling Market Report Segmentation:

Breakup By Component:

- Solution

- Direct Liquid Cooling

- Indirect Liquid Cooling

- Services

- Design and Consulting

- Installation and Deployment

- Support and Maintenance

Solution represents the largest segment. Solutions encompass a wide range of integrated systems and technologies essential for effective liquid cooling, making them the predominant choice among data center operators seeking comprehensive cooling strategies.

Breakup By Data Center Type:

- Large Data Centers

- Small and Medium-sized Data Centers

- Enterprise Data Centers

Large data centers account for the majority of the market share as large data centers have higher power densities and cooling requirements.

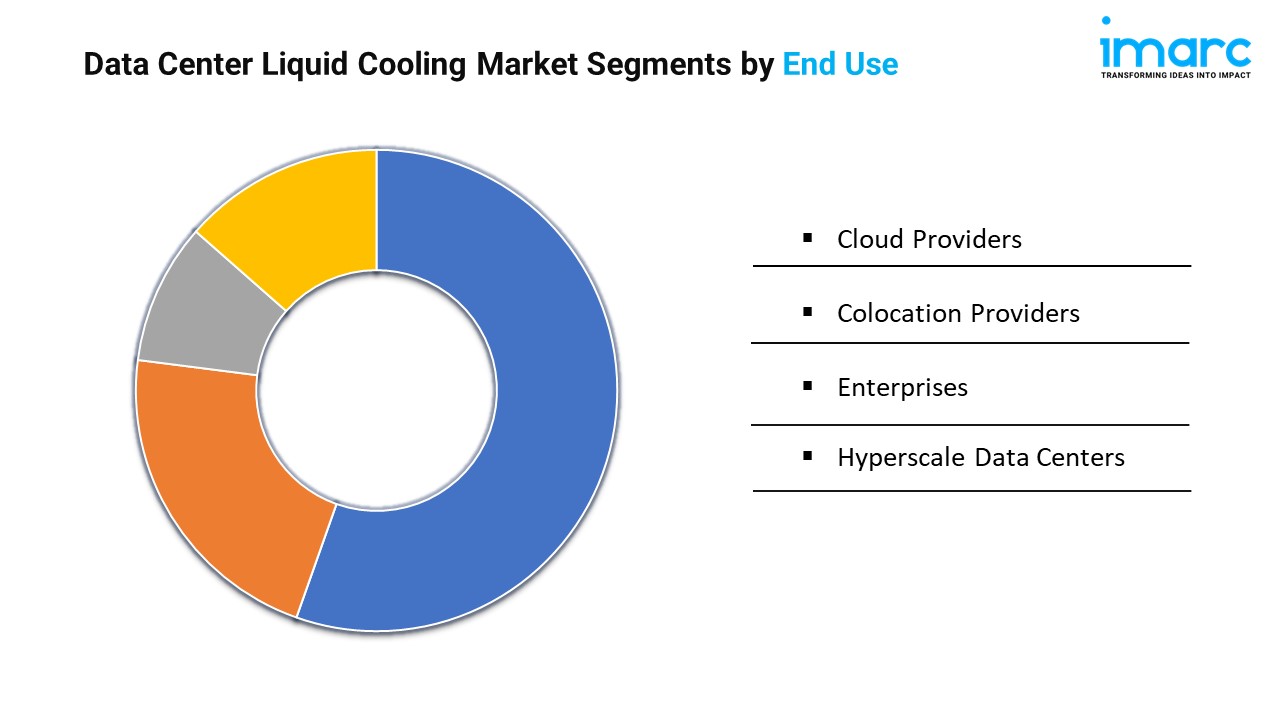

Breakup By End Use:

- Cloud Providers

- Colocation Providers

- Enterprises

- Hyperscale Data Centers

Enterprises exhibit a clear dominance in the market. Enterprises, with their significant investments in IT infrastructure and reliance on data-intensive applications, prioritize advanced cooling solutions to ensure optimal performance and operational efficiency.

Breakup By Application:

- BFSI

- IT and Telecom

- Media and Entertainment

- Healthcare

- Government and Defense

- Retail

- Research and Academic

- Others

IT and telecom hold the biggest market share. The IT and Telecom sectors are characterized by high data traffic and power demands, necessitating efficient cooling solutions to manage the heat generated by their extensive hardware setups.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the data center liquid cooling market. North America is home to a large number of hyperscale data centers and tech giants that are early adopters of innovative cooling technologies, driving significant growth in the liquid cooling market.

Top Data Center Liquid Cooling Market Leaders:

The data center liquid cooling market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Alfa Laval AB

- Asetek A/S

- Asperitas

- Chilldyne

- CoolIT Systems Inc.

- Fujitsu Limited

- Green Revolution Cooling Inc.

- Iceotope

- Lenovo Group Limited

- Rittal GmbH & Co. KG

- Schneider Electric SE

- Vertiv Group Corp.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145